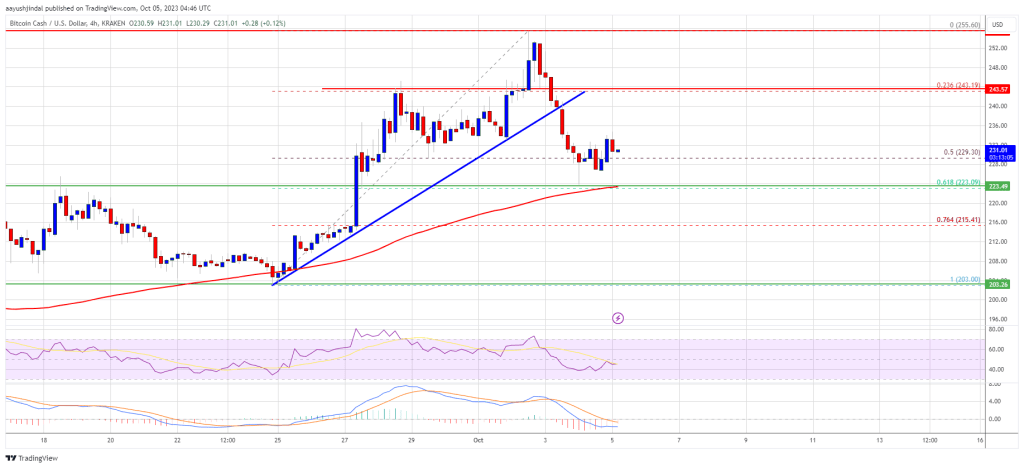

Bitcoin Cash price is holding the key $220 support against the US Dollar. BCH seems to be aiming for a fresh increase unless there is a move below $220. In the past few days, Bitcoin Cash price saw a steady decline from the $255 resistance zone. BCH declined below the $240 support to enter a short-term bearish zone, like Bitcoin and Ethereum. The price declined below the 50% Fib retracement level of the upward move from the $203 swing low to the $255 high. Besides, there was a break below a key bullish trend line with support near $238 on the 4-hour chart of the BCH/USD pair. However, the bulls were active above the $220 support. The price found support near the 61.8% Fib retracement level of the upward move from the $203 swing low to the $255 high. Bitcoin Cash is now trading above $220 and the 100 simple moving average (4 hours). Immediate resistance is near the $236 level. The next major resistance is near $244. Any further gains could lead the price toward the $250 resistance zone. Source: BCH/USD on TradingView.com The next major hurdle is near the $262 level, above which BCH might start a decent increase toward the $280 level or $288 in the coming days. If Bitcoin Cash price fails to clear the $244 resistance, it could start a fresh decline. Initial support on the downside is near the $225 level. The next major support is near the $220 level, where the bulls are likely to appear. If the price fails to stay above the $220 support, the price could test the $212 support. Any further losses could lead the price toward the $200 zone in the near term. Technical indicators 4-hour MACD – The MACD for BCH/USD is losing pace in the bullish zone. 4-hour RSI (Relative Strength Index) – The RSI is currently below the 50 level. Key Support Levels – $225 and $220. Key Resistance Levels – $236 and $244.

Bitcoin Cash Price Holds Support

Downside Break in BCH?

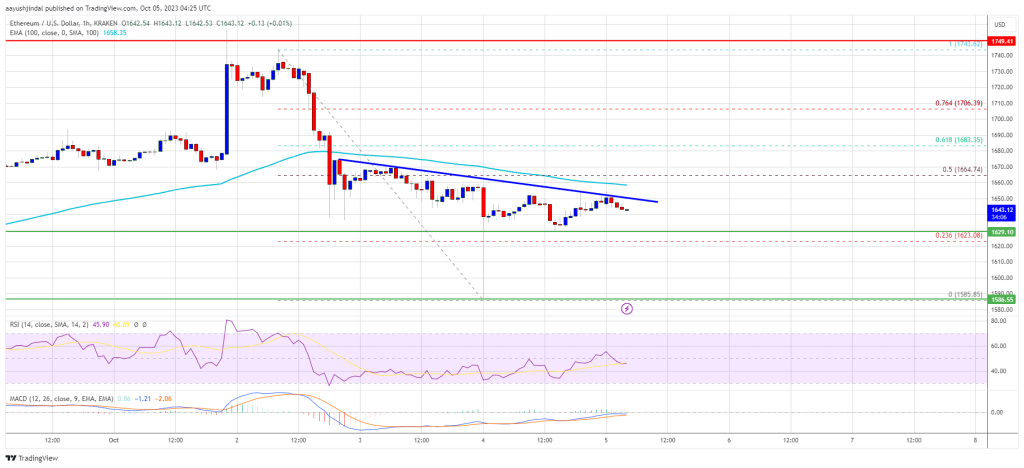

Ethereum price is struggling to stay above the $1,620 support against the US dollar. ETH must clear the $1,665 hurdle to start a fresh increase. Ethereum managed to recover and stay above the $1,620 pivot level. Yesterday, we discussed a bearish reaction in ETH below the $1,650 level, like Bitcoin. A swing low was formed near $1,585 before the price recovered above $1,620. It is now consolidating above the 23.6% Fib retracement level of the downward move from the $1,742 swing high to the $1,585 low. It seems like the bears are active below the $1,650 level. Ethereum is now trading below $1,660 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $1,650 level. There is also a connecting bearish trend line forming with resistance near $1,650 on the hourly chart of ETH/USD. The next major resistance is $1,665 and the 100-hourly Simple Moving Average. It is close to the 50% Fib retracement level of the downward move from the $1,742 swing high to the $1,585 low. Source: ETHUSD on TradingView.com A clear move above the $1,665 resistance zone could start a decent increase. In the stated case, the price could visit the $1,700 resistance. The next key resistance might be $1,720. Any more gains might open the doors for a move toward $1,750. If Ethereum fails to clear the $1,665 resistance, it could start another decline. Initial support on the downside is near the $1,630 level. The next key support is $1,620. The first major support is now near $1,585. A downside break below the $1,585 support might start another strong bearish wave. In the stated case, the price could even visit the $1,540 level. In the stated case, there is a risk of a drop toward the $1,500 level. Technical Indicators Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone. Hourly RSI – The RSI for ETH/USD is now below the 50 level. Major Support Level – $1,620 Major Resistance Level – $1,665

Ethereum Price Holds Support

Another Drop in ETH?

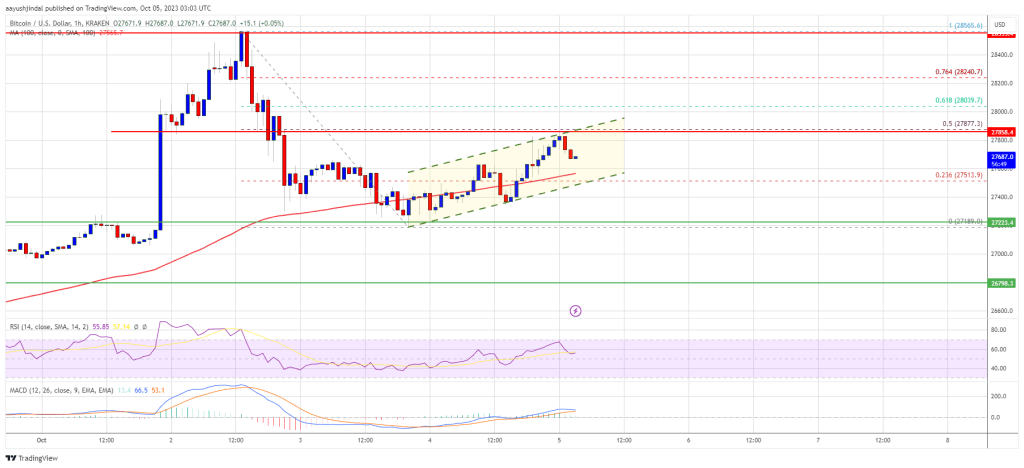

Bitcoin price found support near the $27,200 zone. BTC is now rising and might accelerate higher if it clears the $27,850 resistance zone. Bitcoin price found support near the $27,200 level after a downside correction. BTC remained well-bid and recently started a fresh increase above $27,400. There was a move above the 23.6% Fib retracement level of the downside correction from the $28,565 swing high to the $27,188 low. Besides, the price surpassed the $27,650 resistance and the 100 hourly Simple moving average. However, the bears were active near the $27,850 resistance. BTC struggled near the 50% Fib retracement level of the downside correction from the $28,565 swing high to the $27,188 low. Bitcoin is now trading above $27,500 and the 100 hourly Simple moving average. Immediate resistance on the upside is near the $27,850 level. There is also a key rising channel forming with resistance near $27,850 on the hourly chart of the BTC/USD pair. Source: BTCUSD on TradingView.com The next key resistance could be near the $28,000 level. A close above the $28,000 resistance could start another increase. In the stated case, the price could climb toward the $28,500 resistance. Any more gains might call for a move toward the $29,200 level. If Bitcoin fails to continue higher above the $27,850 resistance, there could be another decline. Immediate support on the downside is near the $27,500 level and the 100 hourly Simple moving average. The next major support is near the $27,400 level. The main support is now near $27,200. A downside break and close below the $27,200 level might send the price toward $26,800 in the near term. The next support sits at $26,200. Technical indicators: Hourly MACD – The MACD is now losing pace in the bullish zone. Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level. Major Support Levels – $27,500, followed by $27,200. Major Resistance Levels – $27,850, $28,000, and $28,500.

Bitcoin Price Holds Support

Another Decline In BTC?

Celsius Network, a bankrupt digital asset lender, has revealed plans to begin repaying creditors using billions of dollars in crypto assets before the year’s end. The company presented a restructuring plan, outlined in a recent filing to a US bankruptcy court, which aims to generate funds for a new corporate spinoff known as “NewCo” and facilitate customer repayments. According to the filing, the plan outlines a distribution of at least $2.03 billion in cryptocurrency to creditors, with the actual amount subject to fluctuations in the cryptocurrency market. This distribution will occur as soon as reasonably practicable after the plan becomes effective, either through the NewCo transaction or an orderly wind down. The NewCo transaction, sponsored by the Fahrenheit Group, is a key component of the plan. It involves the creation of a new cryptocurrency company owned by customers, focusing on Bitcoin mining and staking. NewCo, which aims to maximize liquidity by listing on NASDAQ, will be managed by experienced crypto-native operators from Fahrenheit. The group has committed to injecting up to $50 million as an equity stake in NewCo, aligning the interests of Fahrenheit and creditors who will own shares in the new company. In the event that the NewCo transaction cannot be completed, the plan includes an orderly wind-down option that would provide creditors with better recoveries compared to a Chapter 7 liquidation. Celsius’s legal representative, Christopher S. Koenig, also revealed that the restructured company, expected to emerge from Chapter 11, will receive $450 million in capital and financial backing. However, the focus remains on the successful execution of the NewCo transaction, which would mark a significant milestone as the first revival of a failed crypto platform under Chapter 11, following the industry’s wave of insolvencies last year. While the approval of Celsius’s plan is under deliberation by Judge Martin Glenn, some customers who have been unable to access their funds have expressed opposition. Additionally, an affiliate of Lantern Ventures owed approximately $82 million, has challenged the plan, claiming overvaluation of the new business by Celsius’s advisors. Clearance from securities regulators will also be necessary for the new venture. It is important to note that if the new company were to fail, liquidation could become a possibility, potentially resulting in lower repayments for customers. Nonetheless, Celsius Network’s proposed plan represents a significant effort to repay creditors and potentially revitalize the company, providing hope for both the cryptocurrency industry and affected stakeholders. At present, the native token of the company, CEL, is trading at $0.1535, reflecting a 1.1% decline over the past 24 hours. However, it is noteworthy that the token has experienced a notable upward trend in the last 30 days, exhibiting a substantial surge of over 21% during this period. Featured image from Shutterstock, chart from TradingView.comCelsius Vows To Clear $2 Billion Debt

For the last two years, Ethereum (ETH) has outperformed Solana (SOL), looking at the performance in the weekly chart. However, according to one technical analyst on X, this is about to change, especially considering the candlestick arrangement of the SOLETH chart on the weekly chart. Sharing a screen grab, the analyst who goes by the handle “CryptoGodJohn” on X is optimistic, saying at spot rates, this can be the “right” time for traders to swap their ETH for SOL before the next leg up that will push SOL higher in the next two years. However, whether this will pan out remains to be seen. What’s evident is that the path of least resistance appears northwards, looking at price charts. At the time of writing, SOL is up 71% versus ETH from June. Moreover, zooming in closer, SOLETH prices are teetering around critical resistance levels. Although trading volumes are relatively light and cannot be compared with those of late Q2 2023, sentiment is beginning to shift and favors SOL bulls. The sharp expansion in the year’s second half could be a statement. The SOLETH is at 0.0134 ETH level, a liquidation level that was last retested in July and January 2023. If buyers push harder, lifting the coin above the 0.0162 ETH level at the back of rising trading volumes, bulls of mid-July will be confirmed. In that case, SOL might stretch gains towards the 0.0265 ETH level and return to the September 2022 zone. Even so, although traders are optimistic, it is not immediately clear how prices will react at spot levels. As it is, the SOLETH in the weekly chart is facing rejection. The present bar has a long upper wick, pointing to a possible sell-off in lower time frames. Additionally, SOLETH prices are still defined by the early November 2022 bear candlestick. The bear candlestick is wide-ranging and has high trading volumes, pointing to the rapid conversion of SOL to ETH in a moment of fear. Around this time, FTX, a once-popular cryptocurrency exchange, collapsed. In 2021, FTX and Alameda Research, the trading wing linked to Sam Bankman-Fried, the CEO of FTX, invested $100 million in the Solana Foundation. It is said that FTX and Alameda Research controlled over 50 million SOL. The community feared that with FTX filing for bankruptcy, the over 50 million SOL would likely be sold to repay creditors.

In the sessions ahead, whether SOL will reverse the post-FTX collapse drop remains to be seen. Should it happen, SOL gains at least 50% versus ETH.Will SOL Outperform ETH In 2024 And 2025?

Will Solana Bulls Reverse The Post-FTX Collapse Free-Fall Of Q4 2022?